Lifting the lid on China’s Shadow Banks

Lifting the lid on China’s Shadow Banks.

Claims that China’s entire economy is on the brink of collapse are widespread in Western media, whereas Chinese propaganda outlets insist that their economy has successfully bounced back post-COVID. What’s really going on? To find out, we conducted some research into how serious the problems facing China’s economy really are, and discovered the so-called “Shadow Banking” sector could be the next domino to fall. Shadow Banking is a common name for what the World Bank refers to as “non-bank financial institutions”, that is, any institution that provides bank-adjusting services (lending capital, providing insurance, exchanging currencies etc.) but crucially, doesn’t hold deposits. Don’t be fooled by the dodgy-sounding name: if you use services such as PayPal, you’ve used a Shadow Bank!

According to the South China Morning Post, defaulting property giants such as Evergrande and Country Garden have sparked a crisis in China’s shadow banking sector, which is estimated to account for 86% of GDP (SCMP). How did shadow banking get so big in China? Due to the stinginess of state banks when it comes to capitalist ambitions of businesses and individuals alike, the wealth management products and peer-to-peer loans offered by shadow banks can look like savvy options to everyone regardless of class.

At the center of the shadow banking storm is a company called Zhongrong, which is controlled by the business conglomerate Zhongzhi Enterprise Group. According to CNN, Zhongrong took a tenth of the $87 billion entrusted to it by businesses and individuals, and invested the money into real estate (CNN). Looking at the state of china’s property market since 2020, you can see why we used the domino metaphor at the start of this article, and why some observers are asking whether this could be China’s “Lehman moment” (CNN).

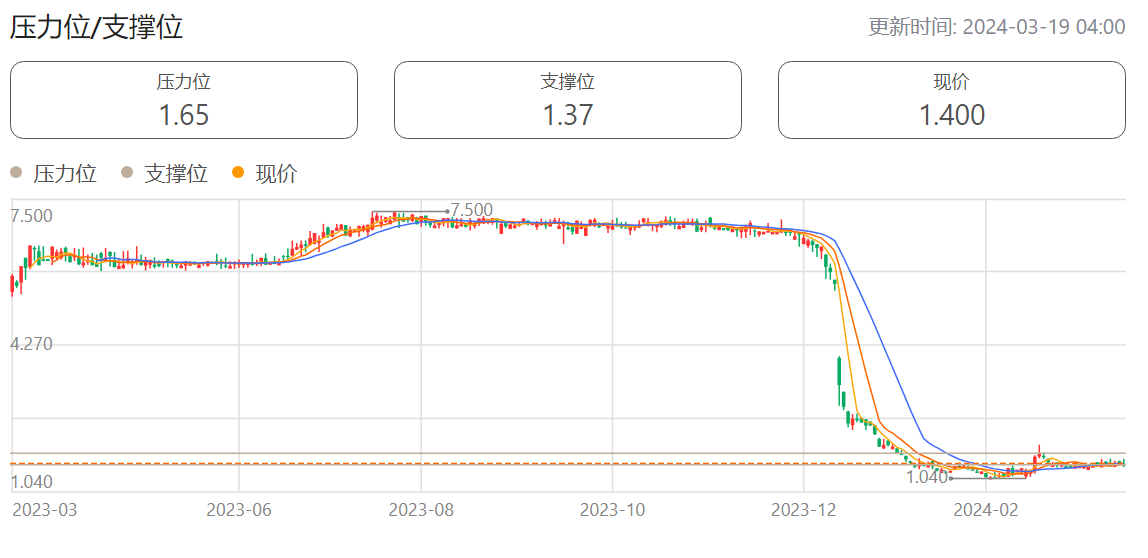

To further demonstrate the dangerous extent to which Chinese shadow banks are exposed to the countries ailing real estate sector; we have delved into Chinese-Language sources to investigate one of the country’s biggest wealth management companies: Haiyin Wealth. What caused their stock to crash at the end of 2023, as shown in the Baidu Stock Market graph below.

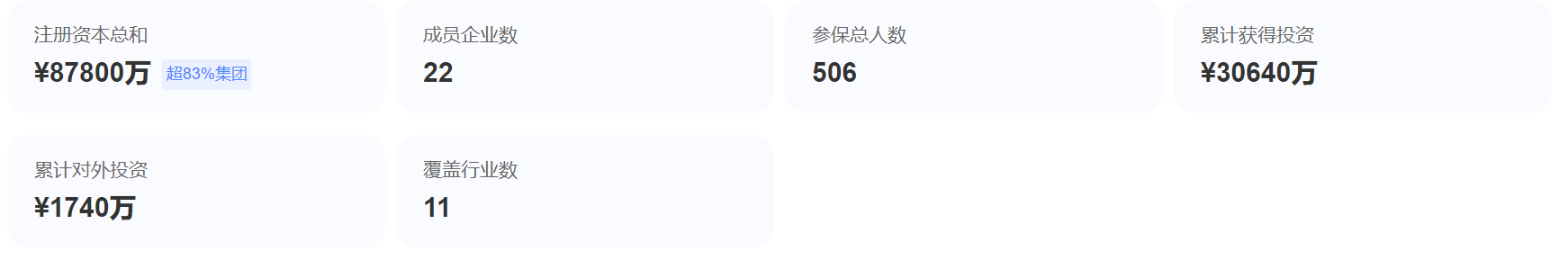

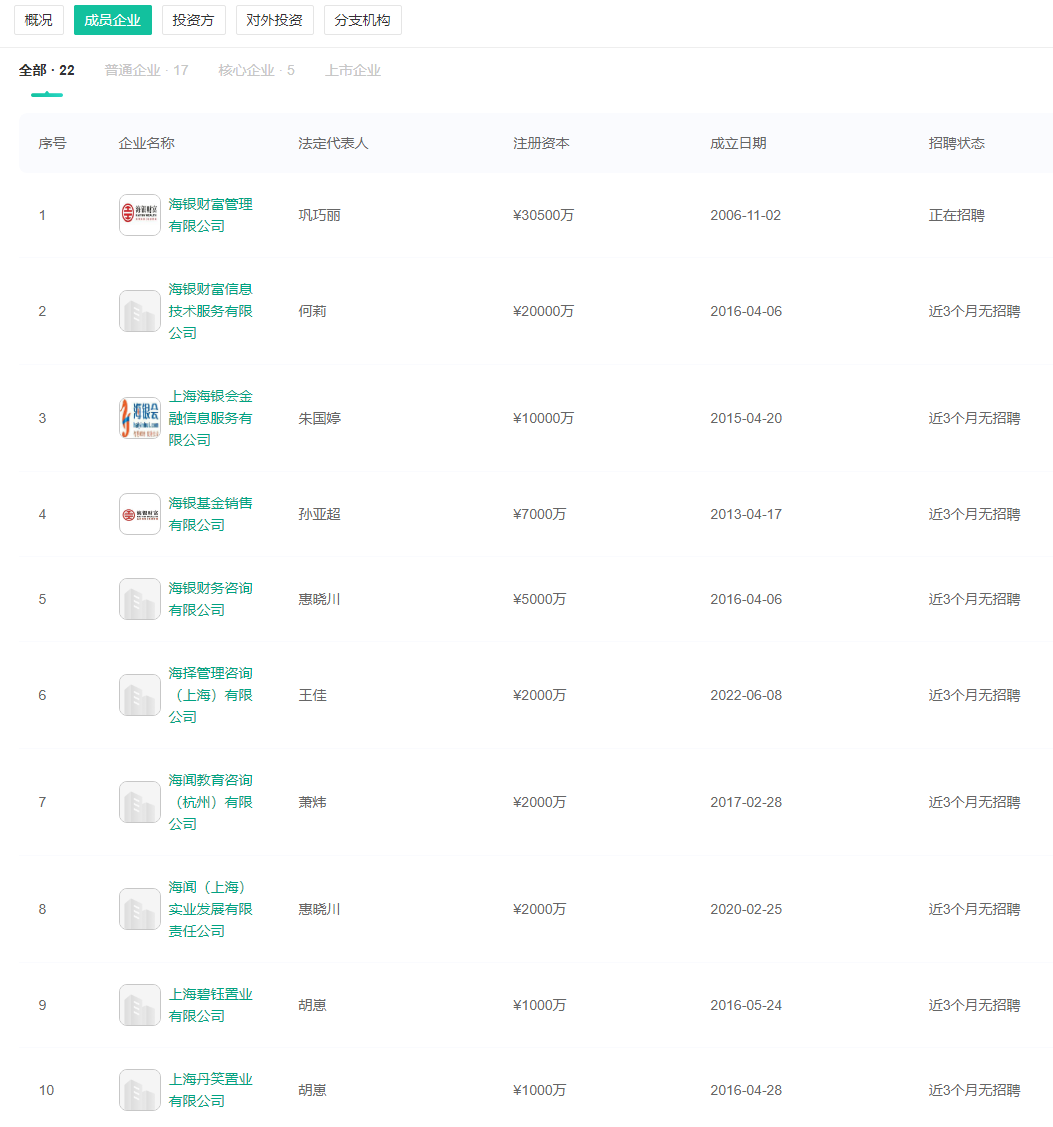

We used the Chinese corporate intelligence platform Kanzhun (看准) to try and find out exactly where Haiyin had been putting investors hard-earned money.

Note, this site also used by China’s vast numbers of unemployed youth to search for jobs. Be prepared to trawl through information about working hours, interviews and salaries. A good place to start is the “Registration Information” tab, which tells you when the company was established, how many employees it has, its registered address and previous names it traded under.

We discovered that Haiyin consists of 22 member companies across 11 industries, including at least two in the real estate sector: Shanghai Biyu and Shanghai Danxiao.

Without being a Kanzhun member, we were only able to see the first 10 results, but this was the first piece of proof that Haiyin, like the majority of shadow banks in China, had exposure to the property market. We wanted to find more detailed information on Haiyin’s investment portfolio, but since this wasn’t something Kanzhun was able to provide, we tried the Wayback Machine. This felt like the most obvious place to look, as thier customers have the right to know where there money was going, right?

… Apparently not. Their corporate profile, strategic planning and wealth management pages were are very vague and there have been no insight papers published since mid-2021.

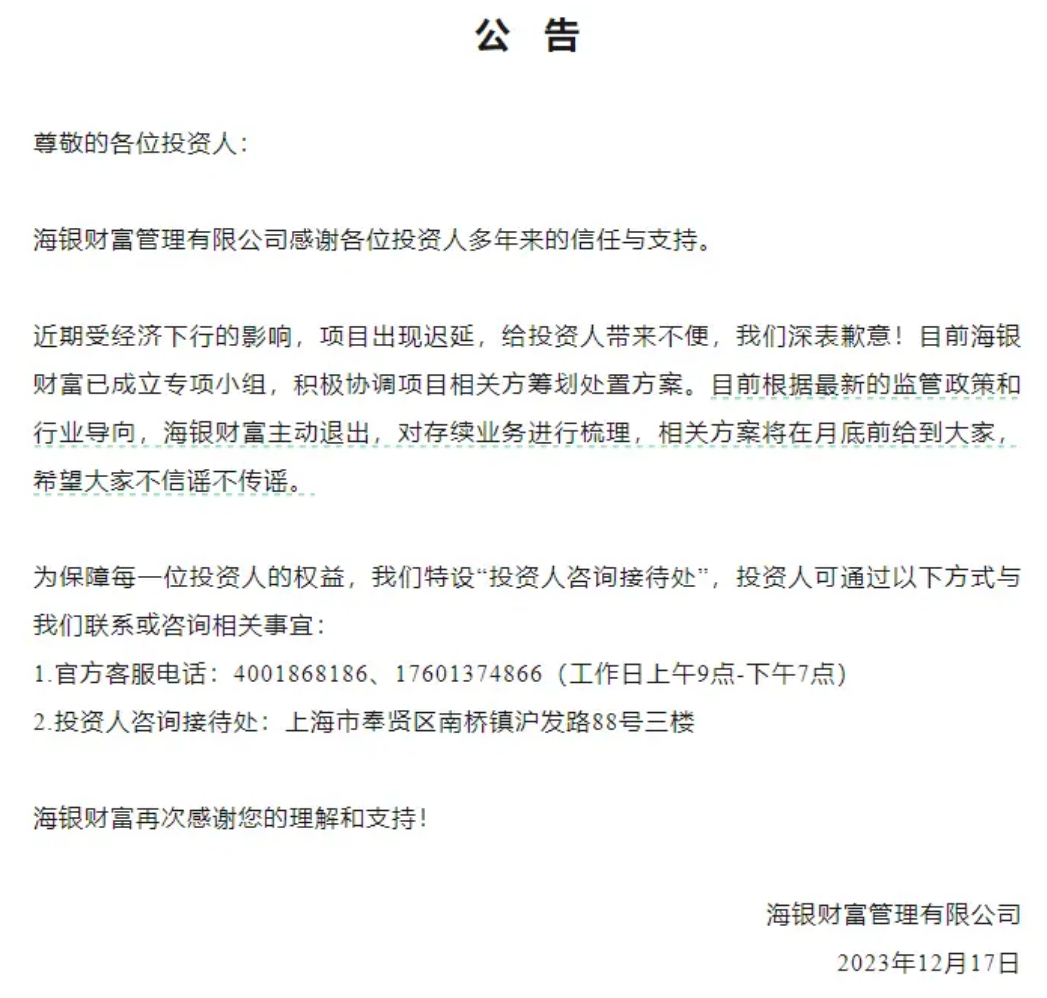

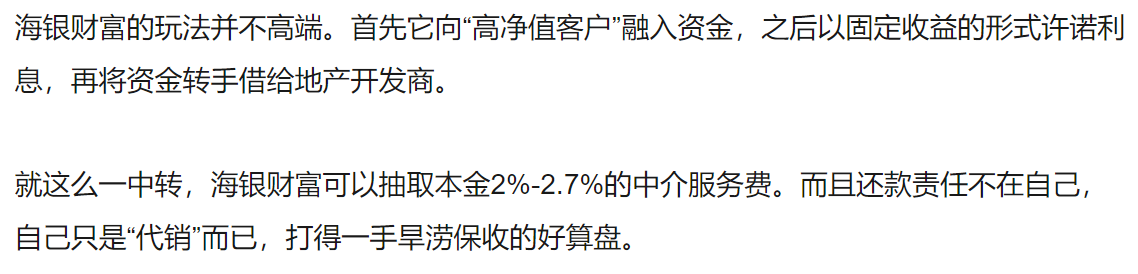

Thinking like a potential investor, we went back to basic searching. Using the Chinese search engine Baidu to search in Chinese “What is Haiyin Wealth Management invested in?” The top result was Haiyin’s official site; the second was a lonely post on the Q&A forum “Baidu Knows”; the third result was an anonymous article on Sohu (Chinese equivalent to Yahoo) published in December last year (Sohu). Titled, “another one of the richest business empires has fallen”, the article explained that Haiyin’s business model consists of lending investors’ money to property developers, on the understanding that they would receive interest from a fixed-income model. Despite charging 2-2.7% in service fees, Haiyin did not take responsibility for repayments to customers, arguing they acting solely as a “sales agent”.

The article claims that as of June 2020, approximately 74% of Haiyin’s transaction volume involved real estate products, going as far as to call the company the “sugar daddy” of China’s real estate sector.

Hinting at the opacity of all Chinese shadow banks , the article’s final analysis reads “no matter the financial product, the underlying asset consists of wholly real estate, meaning that regardless of which product you go for, in reality, you will always be investing in real estate.

Why was the most detailed information about this shadow banking giant found on a non-serious news site, written by an anonymous author? Kanzhun was invaluable for finding out basic information about Haiyin, and would be ideal for a different kind of investigation (into export control avoidance, for example), but was misleading when it came to the company’s current state of affairs: there was no mention of Haiyin’s stock crash or struggles to repay investors. in fact according to Kanzhun, Haiyin is actively recruiting new staff. Looking at videos published by Spotlight on China, amongst others, of anguished Chinese investors protesting outside Hayin’s Shanghai Headquarters in an attempt to recover their life savings, doesn’t exactly make any of us want to dust our our CV’s (Spotlightonchina).

Why is it so hard to find reliable financial information in China? Could it be that those who counter the government’s official narrative that the economy is booming are being silenced? Whatever the case, our investigation into Haiyin Wealth has served to remind us of the importance of not only reading widely across multiple sources, but also choosing the right tools for the job. Our extensive searches across the Chinese web have led us to the conclusion that whilst not necessarily nefarious, due to their extreme exposure to the real estate sector, China’s shadow banks are poised to cause pain to millions of investors across the country, with further city center protests highly likely. The only remaining question is, what will be the Chinese government’s response?